capital gains tax proposal effective date

The House proposes that its capital gains increase apply to sales on or after Sept. Minimum Income Tax on the Wealthiest Taxpayers This proposal would impose a minimum tax of 20 percent on the sum of taxable income and unrealized gains of the taxpayer.

Capital Gains Taxes Are Going Up Tax Policy Center

1 2022 or later for most other proposed changes.

. Bidens Capital Gains Proposal. The proposal would be effective for gains recognized after the undefined date of announcement which could be interpreted as the April 28 2021 date of the release of the American Families Plan or the May 28 2021 date of the release of the Greenbook itself. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Which leads to the oft-asked question of when. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. Bidens Capital Gains Proposal. With no tax law changes your client would expect capital gains tax of 400000 per year for the next three years.

The effective date would be years beginning after December 31 2022. If this were to happen it may not only. No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the Green Book notes an effective date of April 2021 or the date of announcement.

This proposal would be effective for gains required to be recognized after the date of announcement according to Treasury Department materials released Friday afternoon. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. Understanding Capital Gains and the Biden Tax Plan Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

As you review this alert it is critical to keep in mind that. This proposal would be effective for gains required to be recognized after the date of announcement. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate.

This would apply to. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the. All of this is to say that the most likely outcome by far is that if any changes to the top capital gains rate are made which still seems reasonably likely they will.

Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk. 13 2021 unless pursuant to a written binding contract effective on or before Sept. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021.

Proposed effective dates on the capital-gains tax rate were a big open question. The Green Book says this. Taxpayers can also consider other rate arbitrage opportunities as Democrats are largely proposing effective dates of Jan.

Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. Capital gains tax proposal effective date Tuesday April 12 2022 In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the. The effective date for the capital gains tax hike would be april 28 2021 when the american families plan was introduced according to the treasury departments greenbook a compendium of.

Long-Term Capital Gains Tax Rates. Dems eye pre-emptive capital gains effective date. Catching Up on Capitol Hill Episode 13-2021 President Biden has proposed a substantial increase in the capital gains rate.

Additionally the proposal related to the repeal of section 1031 applicability to gains in excess of 500000 per taxpayer would be effective for exchanges completed in tax years beginning after December 31 2021apparently regardless of the date upon which the exchange may have begun. In short we dont yet know the answer to this important question. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains.

Effective Date Considerations May 14 2021. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of. KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when.

The effective date for most of the proposals is Jan. If this were to happen it may not. By contrast the other proposals in the Greenbook generally state that they will be.

How To Write Out A Bill Of Sale Opinion Of Experts Bill Of Sale Template Word Template Business Template

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Historical Capital Gains And Taxes Tax Policy Center

Hong Kong S Tax System Explained Why Levies Are So Low How It Competes With Singapore And Why It S Both Out Of Date And Ahead Of Its Time South China Morning Post

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Mlp Taxation The Benefits And What You Need To Know

Tax Consultants In Islamabad Income Tax Return Income Tax Tax Return

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms Free Fillable Forms Bill Of Sale Template Word Template Business Template

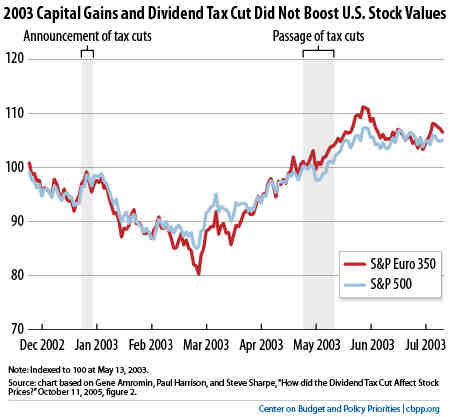

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

How The Tcja Tax Law Affects Your Personal Finances

Qualified Small Business Stock Considerations For 100 Gain Exclusion

House Democrats Propose Hiking Capital Gains Tax To 28 8

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Printable Sample 30 Day Notice To Vacate Letter Form Being A Landlord Lettering Move Out Notice

Banking Financial Awareness 28 29 30th May 2020 Awareness Study Quotes Banking

Free Templates For Office Online Office Com Business Proposal Letter Business Plan Proposal Proposal Templates

Tax Services Provider Company In Usa Harshwal Company Llp Tax Services Accounting Services Business Tax

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others